6th January 2023

LNG as marine fuel: A risky or future-proof investment?

LNG has been described as a transitional fuel for the shipping industry for years now, and a practical solution for shipowners who want to act now on their emissions and not wait on the side-lines.

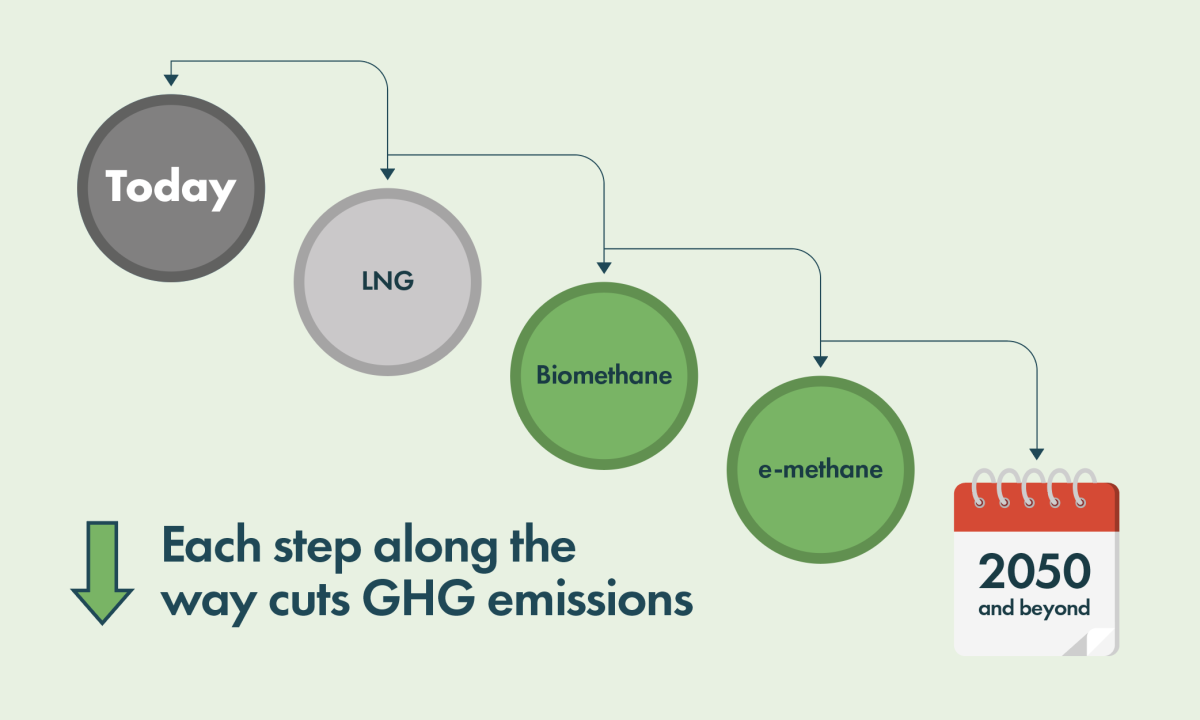

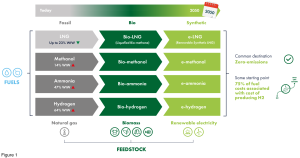

Nevertheless, as of recently, we are also seeing that LNG is becoming a fuel in transition as owners seek to transition to bioLNG and e-LNG. Owners like CMA CGM believe LNG as a marine fuel offers them a pathway to futureproof their newbuilding vessel investments as they can transition to net-zero through drop-in fuels like bio and renewable synthetic e-LNG (e-methane).

Investments in LNG dual-fuel vessels have been record high this year. LNG and other alternative fuels make up 4.5% of the fleet when looking at the gross tonnage and 44% of the orderbook, data from Clarksons Research shows.

Of the orderbook, 38.9% of tonnage is set to use LNG (781 units), 2.2% to use LPG (86 units) and 4.3% due to use other alternative fuels (c.260 units; including methanol (42), ethane (11), biofuels (5), hydrogen (12) and battery/hybrid propulsion (c.200)).

That being said, two major issues have been associated with LNG as fuel, the methane slip and its well-to-wake profile pointing to the fact that shipowners who have invested in the LNG pathway will need to shift to renewable synthetic LNG (e-LNG) in the long-term.

This brings us to the critical issue when it comes to the decarbonization of the sector, the production, and the scalability of green fuels.

Offshore Energy spoke with Steve Esau, Chief Operating Officer at SEA-LNG, a multi-sector industry coalition whose members collaborate to demonstrate the benefits of LNG as a marine fuel throughout the entire value chain, on the future of LNG in the maritime industry amid fears that those who invest in the solution might be facing stranded asset risks.

SEA-LNG says that bioLNG and ultimately e-LNG will be a net zero option for shipping, with the former one being a suitable solution that can help decarbonize shipping today. The organization sees positive signals in Europe that the production of bioLNG is likely to be increased.

Speaking on the key challenges ahead with the production of bioLNG and e-LNG and their adoption in the shipping industry, Esau explained that producers of bioLNG as a marine fuel will face competition from other industries for the feedstock such as the aviation and materials industries.

“However, even accounting for this competition, a recent independent study conducted by the Maritime Energy and Sustainable Development Centre of Excellence at Nanyang Technological University in Singapore, and commissioned by SEA-LNG, estimated that bioLNG could cover up to 3% of the total energy demand for shipping fuels in 2030 and 13% in 2050. If it is considered as a drop-in fuel blended with fossil LNG, bio-LNG could meet up to 16% and 63% of the total energy demand in 2030 and 2050, respectively, assuming a 20% blending ratio.”

He noted that in the long term, shipowners who have invested in the LNG pathway will need to shift to renewable synthetic LNG (e-LNG).

“Production of e-LNG faces the same challenge any other ‘green’ e-fuel – a lack of green hydrogen produced using electrolysers powered by renewable energy. This is the common feedstock required by all e-fuels. Therefore, the build out of renewable energy is the principal obstacle to commercial production of all e-fuels,” he said.

Commenting on the case for e-LNG against e-methanol, Esau said that it was impossible to forecast with any certainty the costs of e-fuels in two to three decades’ time. Nevertheless, since e-fuels share the same hydrogen feedstock, this will make up around 70-80% of the fuel production cost.

When comparing e-fuels, the supply chain logistics and operational advantages of one fuel over another are important, he noted.

“E-LNG has a number of advantages over e-methanol. Firstly, it is more energy-dense, meaning vessel owners can have more space onboard their ships for cargo or passengers. Secondly, e-LNG can be used directly as a drop-in fuel in existing LNG-fuelled vessels. Thirdly, there is a very well-established global bulk transportation and storage network for LNG that can be used to deliver e-LNG to the vessels. Finally, e-LNG is safe – and benefits from over fifty years of incident-free usage and handling of LNG,” he said.

Why should owners choose LNG and bioLNG over methanol or ammonia?

“Waiting is not an option. GHG emissions are cumulative, so it’s essential that the emissions of the entire pathway to net-zero are evaluated, not simply the destination. Analysing a 14,000 TEU container ship commissioned and launched in 2025, if we compare the different alternative fuel pathway choices – LNG, methanol, ammonia and liquid hydrogen with VLSFO – the LNG pathway emits far fewer GHG emissions over the lifetime of the vessel than the other VLSFO and the other alternative fuels.

“This is because fossil LNG offers immediate reductions in greenhouse gas emissions – up to 23% – on a well-to-wake basis compared with fuel oil and indeed compared with ammonia, methanol and liquid hydrogen which are currently only available at scale when produced from natural gas.

“Indeed, these fossil, or grey, forms of alternative fuels have far higher well-to-wake emissions than VLSFO! The LNG decarbonisation pathway is also advantaged because bioLNG is commercially available now, and in growing volumes. The production of biomethane is currently approximately 350x greater than the production of biomethanol on an energy-equivalent basis and it is already widely used in road transportation.”

Helping catalyze the production of new fuels

Owners like Maersk and CMA CGM are investing in the production of green fuels to ensure supply for their newbuilding vessels running on methanol for example. This has been a way of breaking the chicken and egg dilemma that plagued the case for LNG for a long time.

Commenting on the trend and its potential to accelerate the green methanol production market, Esau said:

“It is important to remember that while shipping companies are not fuel producers – they can help to catalyse production of new fuels such as bioLNG, e-LNG and e-methanol. However, for scale to be achieved in the short to medium term, collaborations with major energy suppliers will be required. This is how the uptake of LNG as a marine fuel was originally driven and many SEA-LNG members are already collaborating along these lines for the supply of bioLNG and e-LNG as a marine fuel.

“We should recognise that in global energy terms shipping is a relatively small market. The industry will need to fit in with the energy carrier solutions that energy suppliers are looking at developing for the broader energy transition. The shipping tail is unlikely to wag the dog.”

The methane slip challenge

Engine manufacturers are working on the development of technologies that will eventually eliminate the methane slip from the combustion process. On the other hand, there is a considerable gap in the market when it comes to accurate data on scale, volume and impact of the methane slips that occur on board LNG-powered ships. Some market-based coalitions are being made to address this.

Esau insists that it is important to not take a static view on methane slip, saying that this is a recognised challenge that the industry has made strong progress on overcoming.

“The LNG order book shows that approximately 75% of the LNG-fuelled new builds will use 2-stroke engines. Of the 2-strokes on order, about 70% use high-pressure diesel engines which have negligible methane slip. In order to successfully deal with the issue of methane slip, the first step is to measure it,” he said.

“The 2021 Sphera study, commissioned by SGMF and SEA-LNG, is widely recognised as being the most authoritative study to date on the GHG emissions (including methane) associated with the use of LNG as a marine fuel based on test bed data. The next step is to measure actual operational emissions and, on that basis, develop operational procedures and technological solutions to address methane slip. A number of studies are already underway and planned and there are clear technology pathways to address slip in engines where it is an issue such as oxidation catalysts and high-pressure gas injection.”

LNG will not be the answer for every ship. Therefore, a multi-fuel future is on the cards for the shipping industry. Nevertheless, the shipping sector seems to be lacking a sense of urgency and ambitious decarbonization targets. The key to making this happen faster are clear-long term regulations.

“At SEA-LNG, we recognise that different pathways may suit different sectors or specific ship-types. We anticipate the need for a basket of fuels in the future, and a future in which LNG will play a significant role in the near term, because of its immediate GHG reduction benefits and in the long term, as a consequence of the low risk, incremental pathway to decarbonisation it offers through the use of bioLNG and e-LNG. In order for this transition to happen smoothly, it is critically important that clear, long-term regulations are established, at a global level, by the International Maritime Organization (IMO),” Esau concluded.

This article was originally published by Offshore Energy on December 21, 2022