Commercial

LNG delivers strong returns on investment across different vessel types trading internationally.

LNG is the only alternative to traditional marine fuel oils which is commercially viable for deep-sea shipping.

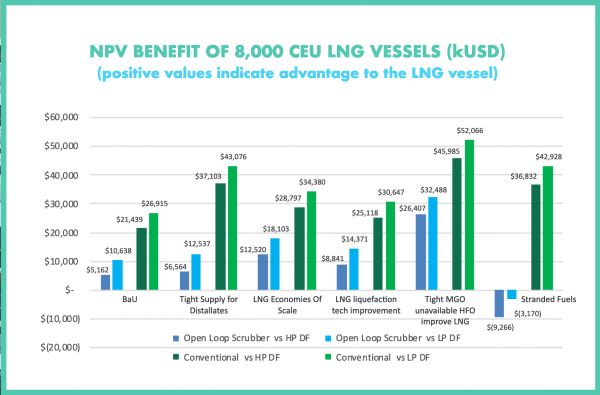

Independent modelling of the investment case for LNG-fuelled vessels across a variety of different vessel types and trade routes using publicly available data on CAPEX shows that LNG provides a compelling business case for ship owners when compared to conventional marine fuels.

Analysis clearly shows that LNG as a marine fuel delivers the best return on investment on a net present value (NPV) basis over a conservative 10-year horizon compared with low sulphur fuel oil, with paybacks varying from less than one year to five years.

| Vessel type / trade route |

Payback |

| Liner (14,000 TEU Asia – US West Coast) | 1-2 years |

| PCTC (6,500 CEU Atlantic US East Coast – Europe) | 2-3 years |

| PCTC (8,000 CEU Pacific US West Coast – Asia) | <2 years |

| VLCC (Arabian Gulf – China) | 3-5 years |

| Capesize bulker (Australia – China) | 2-4 years |

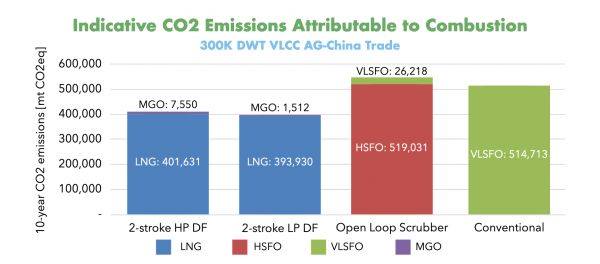

The analysis excludes any financial benefits, for example through carbon pricing, from the lower greenhouse gas emissions from LNG compared traditional marine fuel oils.

LNG as a marine fuel – the Capesize Ore Carrier investment opportunity

27th February 2020

SEA-LNG has commissioned the fourth in its series of independent studies by simulation and analytics experts Opsiana

LNG as a marine fuel – the VLCC investment opportunity

11th December 2019

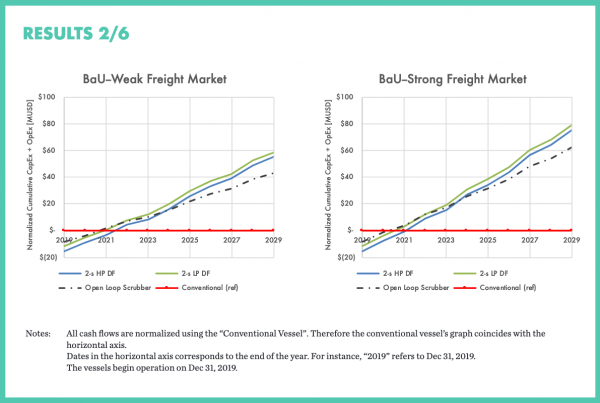

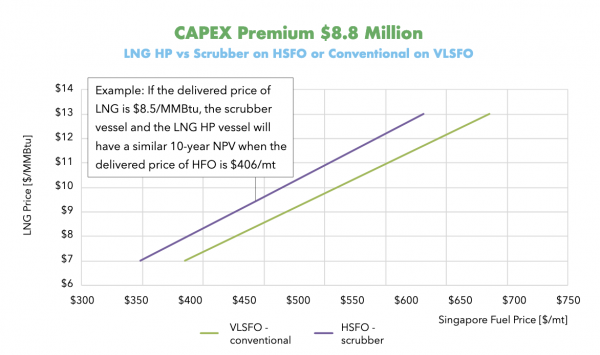

The VLCC investment case study explores the relative investment performance of LNG as a marine fuel for a newbuild 300K DWT VLCC on the Arabian Gulf to China trade route, in comparison with other alternatives currently available and scalable to the shipping industry across three fuel pricing scenarios.

LNG as marine fuel – the PCTC Investment opportunity

11th July 2019

Liquefied Natural Gas (LNG) is a safe, mature, commercially viable marine fuel offering superior local emissions performance, significant Greenhouse Gas (GHG) reduction benefits and a potential pathway to a zero-emissions shipping industry.

LNG as a marine fuel – the Containership Vessel investment opportunity

23rd January 2019

The study is based on a newbuild 14,000 TEU container vessel plying its trade on an Asia-US West Coast (USWC) liner routing.