15th June 2023

COST OF REGULATORY COMPLIANCE LOWER WITH LNG

Introduction

In the growing excitement about the role that alternative marine fuels can play in decarbonising the shipping industry, little attention appears to be paid to the actual pathway to zero emissions and the potential costs of compliance with emerging regulations. In this research, we will look at the implications of different fuel choices for ship owners and operators.

Pathway to zero emissions

Almost all currently available alternative fuels including LNG, grey methanol and grey ammonia are produced from natural gas. In China, methanol and ammonia are also produced from coal. All these fuels share a common pathway to net zero emissions – from fossil-based or fossil-produced fuels today to a synthetic, or electro-fuel destination as and when ample supplies of renewable electricity generation become available, likely sometime mid-century. Fuels derived from sustainable biomass, such as bio-LNG and bio-methanol have a key role to play in the medium term.

Source: ABS 2021, Sphera 2021 & SEA-LNG analysis

While the different fuels share a common destination, their journeys begin from different starting points in terms of greenhouse gas (GHG) emissions. Fossil (grey) LNG offers immediate GHG reductions on a full lifecycle, well-to-wake basis of up to 23%, compared with VLSFO. Emissions of grey methanol are 14% higher than those of VLSFO and for grey ammonia, the percentage increase is 47%.

The negative GHG emission attributes of grey methanol and grey ammonia have major implications for decarbonisation. To achieve the same emissions reduction as grey LNG, grey methanol and ammonia will need to be blended with significant volumes of very expensive, potentially scarce amounts of green methanol and green ammonia derived from sustainable biomass or renewable electricity. Since the grey versions of methanol and ammonia – being produced mainly from natural gas (often LNG) – are already approximately double the cost of LNG, all this adds up to some very expensive alternative fuel choices.

Fuel costs

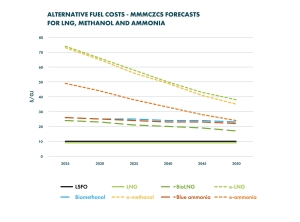

So, given what we know about the alternative fuel choices let’s look at the potential costs of these alternative marine fuels. The Mærsk Mc-Kinney Møller Center for Zero Carbon Shipping (MMMCZCS) has done extensive and credible work on fuel cost projections for renewable and low carbon versions of LNG, methanol and ammonia which is summarised in the chart below.

(Figure 1) Source: MMMCZCS

This analysis combined with long term average prices for LNG at $9/GJ, grey methanol of $21/GJ (Methanex) and grey ammonia of $23/GJ (IEA) paints the following picture:

- Grey methanol and grey ammonia are at least twice as expensive as LNG and LSFO.

- Bio-derived fuels are significantly more costly – up to 2.5 times more expensive than their grey versions. Over time costs should come down, especially as more emphasis is placed on dealing with global waste issues and realising the benefits of the circular economy.

- Bio-LNG is the lowest cost renewable, or green fuel, significantly cheaper than bio-methanol.

- Blue ammonia i.e., ammonia produced from natural gas using carbon capture and storage, has costs similar to bio-methanol.

- Electro-fuels (green e-LNG, green e-methanol, and green e-ammonia) are five to eight times more expensive than the marine fuels used today. These ratios will fall as the costs of renewable electricity and electrolysis fall but the estimates are that they will still be 2.5 to 4 times more expensive by mid-century.

- Green e-ammonia is potentially the cheapest electro-fuel in the long term. However, there are significant challenges to be overcome before it can be used as a marine fuel relating to the development of propulsion systems, low energy density and major safety issues.

- The costs of green e-LNG and green e-methanol are likely to track each other very closely. It should be noted that this analysis does not consider infrastructure and supply chain investments that must be made for methanol and ammonia. These investments have in large part already been made for LNG.

Many other estimates for future fuel costs exist in the public domain and while the numbers differ, the high-level trends, driven by physics and chemistry, are broadly consistent. The implications are clear: green shipping fuels are clearly going to be very expensive and ship owners, operators and charterers are only likely to buy them if required to do so by regulators, such as the IMO and EU, or by customers seeking to meet their own voluntary decarbonisation targets. The decisions by customers and ultimately consumers will be difficult as they will need to balance competitive costs with ESG demands and regulatory requirements.

Regulations

Regulations to address the climate impact of shipping are evolving rapidly. For example, the IMO’s Carbon Intensity Indicator (CII) came into operation in 2023 and the EU is bringing carbon pricing to shipping through its inclusion in the European Union’s Emissions Trading System (EU ETS) starting from 2024. As with many new regulations, there are major issues with the specifics especially as they relate to different vessel types and how they are operated. These regulations are likely to evolve over time. The regulation we would like to focus on in this paper is the European Union’s FuelEU Maritime. This new regulation will have major cost implications for European and International shipping calling at European ports from 2025 onwards.

FuelEU Maritime

FuelEU Maritime is a goal-based regulation designed to accelerate the maritime industry’s decarbonisation through the adoption of renewable and low-carbon fuels and technologies. It does so through the application of targets for GHG energy intensity reductions for the energy used on board ships from 2025 onwards. The regulations will apply to EU and non-EU ships above 5,000 gross tonnage and to all energy used on board in or between EU ports, as well as 50% of energy used on voyages where the departure or arrival port is outside the EU.

GHG reduction targets are determined against a reference value reflecting the fleet average GHG intensity of energy used on-board by ships in 2020 and reduced by the following percentages: 2% in 2025, 6% in 2030, 14.5% in 2035, 31% in 2040, 62% in 2045, and 80% in 2050.

(Figure 2)

GHG emissions are measured on a well-to-wake basis and include emissions from non-CO2 gases, including methane and nitrous oxide. Significant penalties for non-compliance with the GHG targets are included. The penalty will be calculated on an annual basis using a formula which converts the compliance imbalance in energy terms to a tonne equivalent of Very Low Sulphur Oil (VLSFO) multiplied by €2,400.

What we can see immediately is that ships fuelled on grey methanol and grey ammonia will not be compliant with this new regulation. Grey Methanol is about 14% above the VLSFO baseline and grey ammonia, 47%. Grey LNG, as noted earlier (based on two-stroke engine technologies) is some 20% below the VLSFO line. Grey Methanol and grey ammonia will need to be blended with significant volumes of green versions of these fuels simply to reach the GHG performance of VLSFO, let alone the proposed decarbonisation pathway. Ships using grey LNG on the other hand will be compliant until 2039 – here we are referring to the deep-sea vessels, powered by two-stroke engines which transport the majority of the world’s goods.

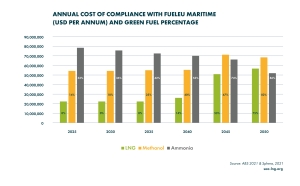

Let’s look in a little more detail at the cost of compliance for a 14K TEU new build container vessel coming into operation in 2025 with an average fuel burn of 146 tonnes of VLSFO equivalent (approximately 6,800 GJ) per day. Such vessels are already on the orderbook for LNG and methanol. While ammonia-fuelled vessels will not be available in this time frame, we have included this solution for the purposes of illustration.

The chart below illustrates the annual costs of compliance with FuelEU Maritime using the three different fuels together with the green fuel blend percentages required. The fuel costs are calculated using the forecasts developed by the MMMCZCS and with long term historic average prices for grey methanol and ammonia from Methanex and the IEA respectively. The following simplifying assumptions are made:

- The entire energy used on board the ship is subject to FuelEU Maritime GHG intensity target.

- GHG savings for LNG are assumed at 20% – representative of the two-stroke engine technologies used on these vessels.

- All bio and electro-fuels are assumed to have zero GHG emissions.

- Pilot fuel is not taken into account.

- LNG and methanol pathways use a bio drop-in until 2044 and a 50/50 bio / electro-fuel drop-in from 2045 onwards, recognising the likely growing availability of electro-fuels and constrained availability of biofuels.

- The ammonia pathway assumes a grey ammonia and green e-ammonia blend.

(Figure 3)

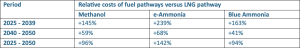

From simple visual inspection, we can see that the LNG pathway is significantly lower cost than both the methanol and ammonia pathways. The table below shows this in terms of percentage cost increases of the different pathways compared with the LNG pathway – also including the blue ammonia pathway (ammonia produced from natural gas using carbon capture and storage).

(Table 1)

It is clear from this analysis that the LNG pathway to compliance offers massively lower fuel costs than that for both the methanol and ammonia pathways, particularly in the first 15 years of the vessel’s life – a period critical for vessel financing decisions. The methanol pathway is approximately 2.5 times more expensive and the ammonia pathway, 2.5 to 3.5 times more expensive.

This is driven by the immediate GHG reductions provided by grey LNG compared to the increases in emissions associated with grey methanol and grey ammonia. Methanol starts in a negative position compared with LNG or VLSFO, as might be expected, as it is produced from natural gas (or coal in China). As we move down the pathway over the next decade or two, bio-methanol is more expensive than bio-LNG and the destination costs of green e-LNG and green e-methanol track each other closely. Even if the costs of green e-ammonia may be lower than those of green e-LNG and green e-methanol, the ammonia pathway costs do not reach parity with LNG until 2050 or later.

The bottom line from this simplified analysis is that in the basket of alternative fuels currently being discussed for the container sector, LNG is the option which offers the lowest cost of compliance for FuelEU Maritime. Similar analysis can be undertaken for other sectors and while the absolute numbers will be different the cost ratios for the different pathways will be similar.

SEA-LNG is in the process of developing a cost of compliance calculator which will enable ship owners, investors, charterers, and operators to explore the commercial implications of different fuel choices in complying with EU and IMO regulations for different ship types and trading routes. There is more to come on this later in 2023.