5th December 2024

The LNG pathway is only ‘two minutes into the hour’ of our journey to net zero, says SEA-LNG

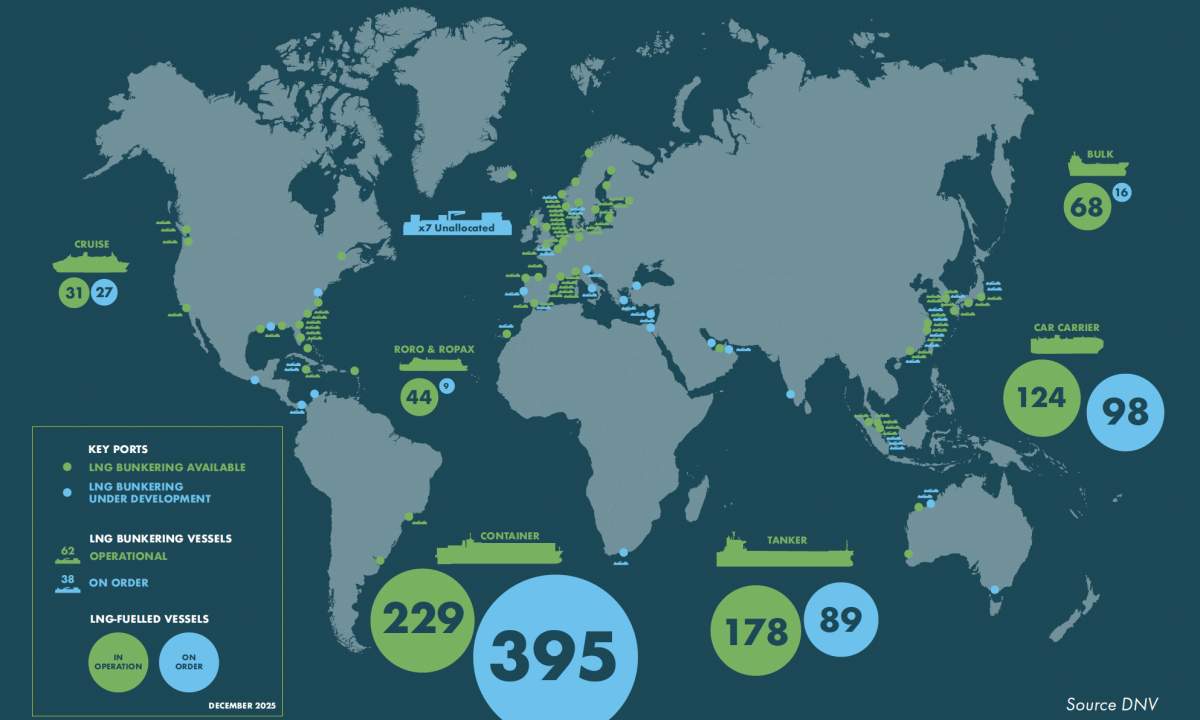

Industry coalition SEA-LNG notes that while the approximately 2,200 LNG-fuelled vessels and LNG carriers represent only ‘two minutes into the hour’ of the global fleet of approximately 60,000 deep sea vessels, it remains an adolescent fuel that is maturing significantly faster than other alternatives. However, the LNG pathway still needs more investment, especially in landside facilities for liquefaction near ports, bio and synthetic methane production and bunkering capacity worldwide.

Peter Keller, Chairman, SEA-LNG, said: “There are approximately 60,000 deep sea ships on the water and, today, we’re looking at around 600 LNG capable ships afloat with a further 600 on order. There are another 1,000 LNG cargo carriers and bunker vessels of varying sizes. While that’s a small percentage of the global fleet, as the clock ticks towards shipping’s emissions reduction targets, the LNG pathway is maturing far faster than other alternative fuels.”

According to DNV there are currently 54 methanol vessels and 2 ammonia vessels on the water.

There are aspects of LNG usage that are fully mature – safety for one. LNG is easy to transport, poses minimal, if any, risk to marine environments, has a low flammability range and is non-toxic. Effective regulations, standards and guidelines for safe operations are widespread, and LNG has been shipped around the world for almost 60 years without any major incidents at sea or in ports.

Keller continued: “When compared to traditional fuels, LNG is more of a teenager with all the growing pains, challenges and victories associated with adolescence. But it is maturing all the time as the market continues to grow, new build orders continue to rise, and the LNG pathway with biomethane and eventually e-methane produced from renewable hydrogen, gains acceptance globally. Shipping stakeholders are investing in LNG because it provides a low risk, incremental pathway for decarbonisation, starting now. The other alternative fuels are basically toddlers by comparison. And when it comes to safety, some are mere newborns!”

This year has witnessed unprecedented investment in the maturing and scaling of LNG from ship owners. LNG is starting to dominate as the preferred future fuel pathway. However, the bunker market, while growing substantially, is lagging and concerns persist regarding the ability to supply the rapidly growing fleet of LNG-fuelled vessels.

Keller noted: “With high profile owners now choosing the LNG pathway, we anticipate this trend will continue and accelerate through 2025 and beyond. As the various alternative fuel pathways mature, there is a growing realisation that, despite previous aspirations, some alternative fuel pathways – like the LNG pathway – are more practical and realistic than others. While investment in newbuild LNG-fuelled ships is robust, we need to see the same for bunker vessels, supply and liquefaction infrastructure. As the LNG pathway continues to mature and the use of liquefied biomethane and eventually e-methane increases, the delivery of the fuel to vessels must be assured and the investment gap closed.”

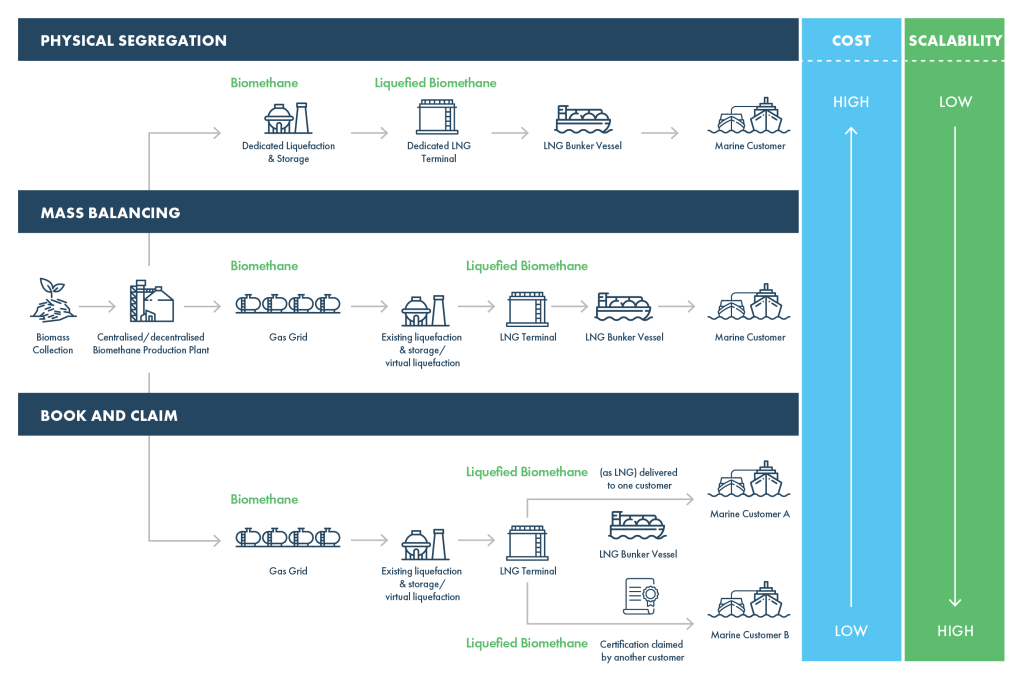

Another critical need in the maturing process during a period of increased regulation of carbon emissions is the adoption of standardised chain of custody models on a worldwide basis. Chain of custody models are becoming increasingly important to maritime decarbonisation as they provide mechanisms to verify that the fuels used are low carbon. Such verification creates investor confidence in new fuel supply chains and accelerates the transition to low-carbon fuels, enabling early adoption in conditions of limited supply. They will create a market for green fuels by connecting buyers to fuel producers away from bunker ports enabling faster scaling and providing flexibility to shipping companies at lower cost. For more information on Physical Segregation, Mass Balancing and Book & Claim, click here.

Keller concluded: “As LNG and the pathway to net zero ascends to adulthood in the coming years, the rewards that our environment reaps will be significant and realistic – given how well we have matured and how conscious we were of what needed to be accomplished.”

Shipping stakeholders are investing in LNG because it provides a low risk, incremental pathway for decarbonisation, starting now. The other alternative fuels are basically toddlers by comparison. And when it comes to safety, some are mere newborns!

Peter Keller, Chairman, SEA-LNG,