16th June 2021

Putting BioLNG and Synthetic LNG Into Focus

This OpEd first appeared in Martime Executive on 15th June 2021

There seems to be a blind spot in maritime shipping’s road to decarbonization. And blind spots are not a good place to be. Those that say LNG is “not a plan to get to zero” seem to be missing some very important points.

While LNG is not the end game, it is the starting point to get to zero. Through the uptake of bio and eventually synthetic LNG, it provides a very clear and achievable pathway which can start today. As an industry, if we do not sharpen our focus and put bio and synthetic LNG firmly in our vision, we risk not realizing the potential of a safe and scalable solution for a decarbonized future.

Known knowns

We know that LNG is available now. It is proven safe, reduces SOx and particulates to negligible levels and NOx by up to 95 percent. LNG also reduces GHG emissions by up to 23 percent on a full lifecycle, well-to-wake basis. We know that in combination with existing design efficiency measures it can enable a shipowner to achieve the IMO’s 2030 target of reducing CO2 emissions by 40 percent compared to 2008. While LNG by itself cannot meet the 2050 targets of 50 percent, if we adjust our mirrors slightly, we will see bio-LNG emerging into our line of sight and showing a pathway to 2050.

BioLNG is increasingly recognized as a sustainable option that can be ‘dropped in’ and blended with LNG, with no changes required onboard the vessel. It also uses existing LNG bunkering infrastructure. And we are seeing this in action today. Unlike other alternative fuels being discussed, bioLNG is available to shipping now and production is scaling up rapidly. In November 2020, Total completed the world’s largest LNG bunkering operation to date in Rotterdam, supplying 17,300 cubic meters of LNG to the CMA CGM Jacques Saade, 13 percent of which was bioLNG. A month later, UECC bunkered the Auto Energy with drop-in bio-LNG, and in Finland, Gasum has bunkered ESL Shipping’s dry bulk carrier Viikki with 100 percent renewable bio-LNG. The IEA estimates that biomethane (bioLNG in gaseous form) production from sustainable feedstocks in Europe has the potential to grow from 18 bcm today to 125 bcm by 2050 – representing more than 25 percent of today’s total EU gas consumption. BioLNG is a “known known.”

Byproducts of byproducts

BioLNG has many more significant advantages. Sustainable bioLNG is produced from existing agricultural, forestry and human waste streams. Depending on the production process it can capture methane that would otherwise be vented into the atmosphere. This results in a fuel that is not just carbon neutral but has the potential to be carbon-negative in terms of lifecycle GHG emissions. Additionally, digestate, a nutrient-rich by-product obtained during the production of biomethane, can be used as a biofertilizer to nurture our soils.

The ability to support the circular economy and re-use the global economy’s waste streams goes largely unnoticed. Yet this significant benefit must be considered in any serious discussion of alternative fuels.

E-fuels

If we adjust our mirror even further, carbon-neutral synthetic LNG comes firmly into view. As credible as any other synthetic fuel, such as hydrogen and ammonia, synthetic LNG must be considered in the basket of future fuels powering the global shipping fleet in 2050. All of the processes required in the production of synthetic LNG are proven. The Wertle “power-to-gas” plant, producing synthetic methane, has been operated by Audi since 2013. A number of companies have ambitious plans to bring this technology to scale in countries such as Australia which has huge renewable energy (solar) resources and existing LNG export infrastructure.

Similar to other synthetic fuels, such as hydrogen and ammonia, the production capacity of synthetic LNG is dependent on the amount of available renewable electricity. Therefore, the first thing that needs to happen to make these synthetic fuels a reality is massive investment in renewable energy capacity, in technologies such as wind and solar. Clearly, this is beginning to happen globally.

Synthetic LNG has the advantage that, like its cousin, bioLNG, it also functions as a “drop-in” fuel. It poses no compatibility issues, as the methane in synthetic LNG is chemically identical to methane in existing LNG.

What is often missed in the future fuels discussion is that bioLNG and synthetic LNG can be transported, stored, and bunkered using existing infrastructure. This is in contrast to other alternative fuels such as hydrogen and ammonia, which will require new supply chains and significant investments.

Consequently, the use of LNG supplemented by bioLNG now and synthetic LNG as and when it becomes widely available enables the shipping industry to incrementally decarbonize, starting now.

Comparing apples with apples

What is essential is that all potential future fuels are properly evaluated on a comparative basis. Comprehensive well-to-wake analysis is essential, using current data and taking actual operational environments into account. Implications for highly relevant stakeholders such as seafarers, ports and port communities must also be assessed. Without this detailed analysis there is a risk of flawed policy and wasted investments.

LNG is the starting point

LNG may not be the end game, but it is a starting point to get to zero. It provides a very clear and achievable pathway which has already been demonstrated.

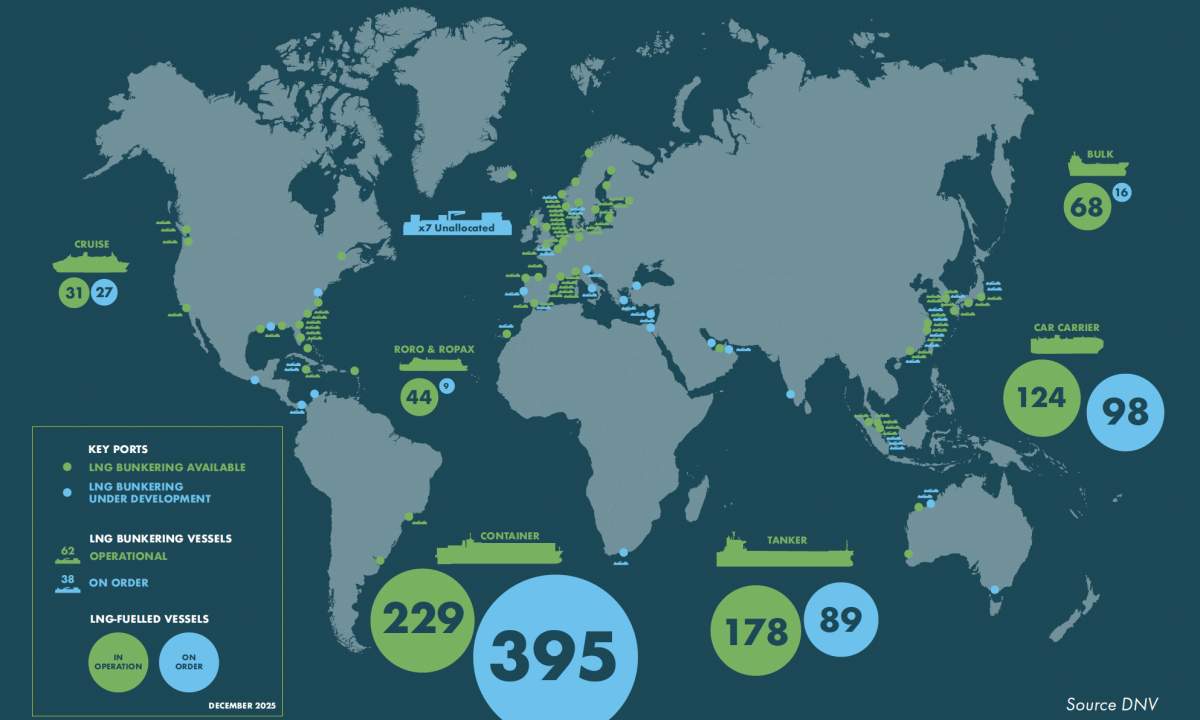

Recognition of this pathway is continually growing. The increase in the number of newbuild orders fueled by LNG demonstrates confidence in LNG and its decarbonization pathway through its bio and synthetic cousins. Engine manufacturer MAN Energy Solutions says that around one-third of all new engines ordered are dual-fuel with LNG accounting for the largest portion of these orders. And Martin Christian Wold, Principal Consultant at DNV, recently noted that nearly 20 percent of vessel orders placed this year are LNG-fueled, with the majority of the orders for large vessels trading globally.

Shipping giants across the world are announcing investments into LNG-fueled newbuildings. In support of increasing uptake, LNG infrastructure continues to build out quickly. According to Shell’s recently published LNG Outlook 2021, LNG bunker demand is expected to expand from just above one million tons in 2020 to 3.5 million tons in 2023. This rapid growth is based on the addition of more than 250 LNG-fueled ships to the current fleet, supplied by the 45 bunker vessels planned to be in operation by 2023.

Despite concerns of a blind spot, the growing momentum behind the LNG pathway shows that the very real potential of bio and synthetic LNG is not hidden from everyone’s view. LNG is not so much a transition fuel as a fuel in transition. However, if we are going to achieve the IMO GHG emissions reductions targets of 2050, and rapidly achieve net-zero we need to start today. We cannot afford to wait — the industry must adjust its mirrors now to ensure that the potential of all future fuels is firmly and clearly in our line of sight.