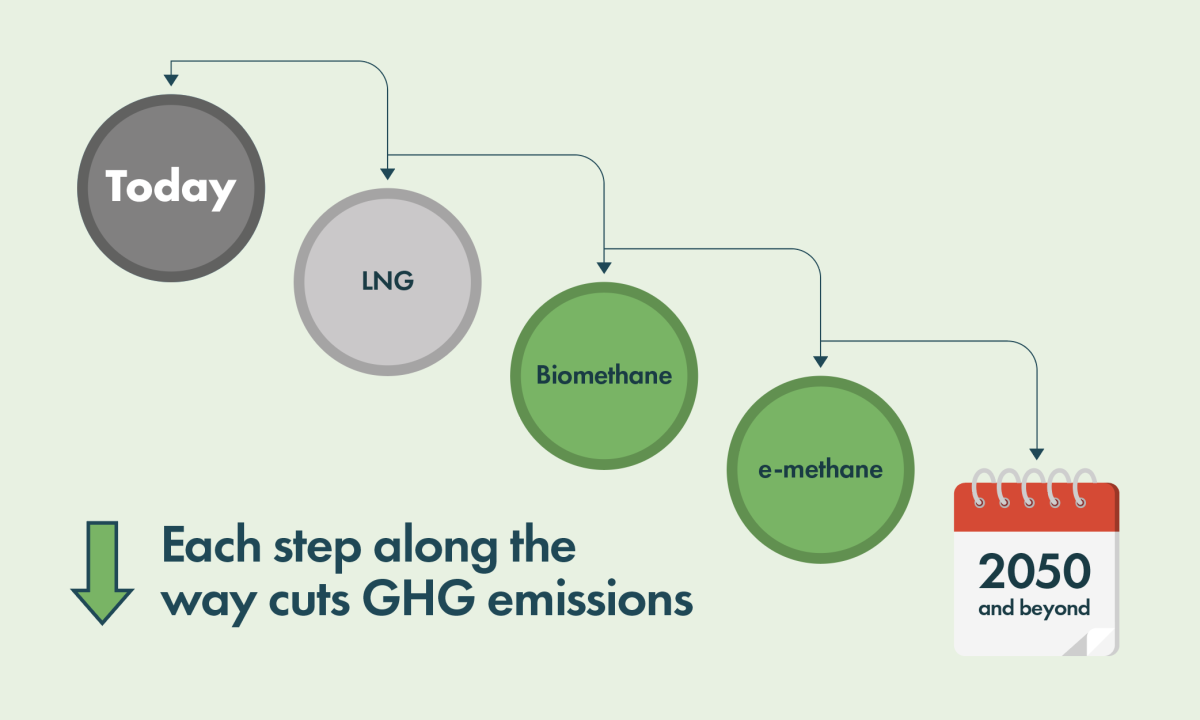

MOVING TOWARDS A CLEANER FUTURE

LNG offers a low risk, incremental pathway to a net-zero GHG emissions future, utilising existing infrastructure and proven, safe shipboard technology.

BENEFITS OF LNG

LNG provides an answer to shipping’s challenges today and in the future through its green forms liquefied bio and e-methane. LNG is the only commercially viable and scalable alternative marine fuel that can enable the shipping industry to remain competitive while phasing-out emissions this century.

About Us

SEA-LNG is a multi-sector industry coalition established to demonstrate the benefits of the LNG pathway to meet the environmental, commercial and operational challenges of the 21st century.

We fully believe in the benefits of LNG and have been working diligently to bring about a positive and pragmatic change – driving the widespread adoption of LNG as a leading marine fuel, as well as liquefied bio and e-methane, helping to reduce emissions for the shipping industry.