Study finds LNG dual-fuel vessels lowest cost compliance solution to decarbonise shipping

17th December 2024

THETIUS PERCEPTION STUDY UNPICKS COMPLEXITY OF MARITIME PATHWAY TO NET-ZERO

25th January 2024

New independent study confirms bio-LNG’s role in shipping’s decarbonisation

5th October 2022

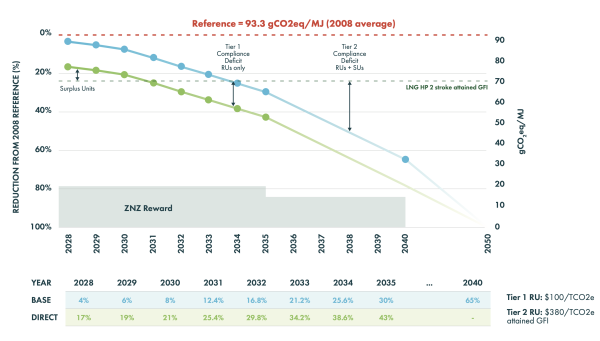

LNG RETROFITS WILL RATE HIGHER UNDER CII THAN HFO/SCRUBBER OR VLSFO ALTERNATIVES

9th August 2022

LNG retrofit will make it easier for vessels to comply with CII regulations than fuel oil options, helping to maintain and improve financial viability for the remaining operational lifetime of the vessel.

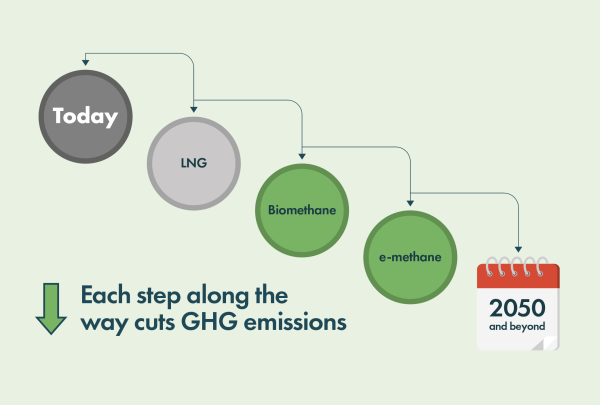

LNG – A FUEL IN TRANSITION

8th February 2022

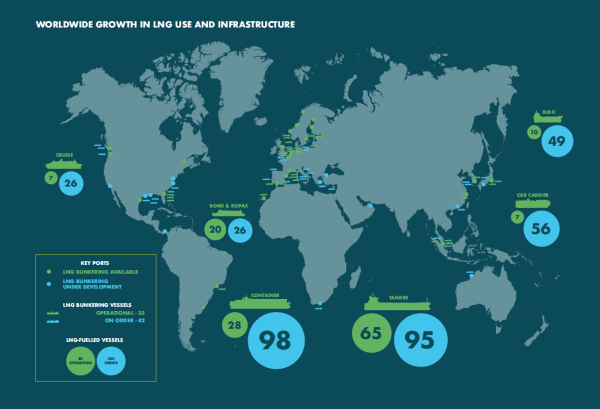

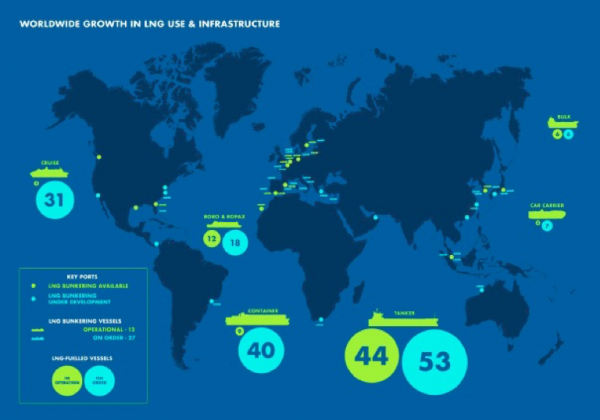

SEA-LNG's view from the bridge 2021-22 | SEA-LNG is pleased to share with you its overview of LNG as a marine fuel in 2021-2022. This resource highlights how the shipping industry has advanced along the LNG pathway to decarbonisation and outlines what progress will be made in 2022.

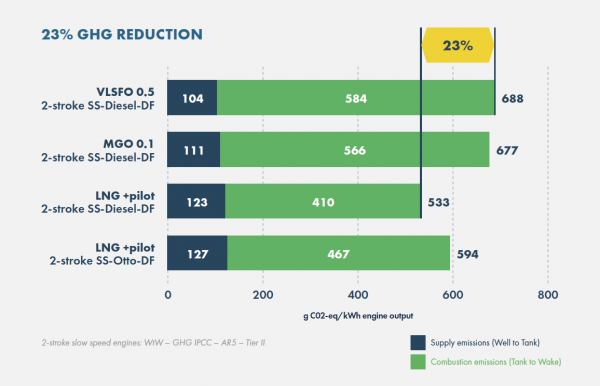

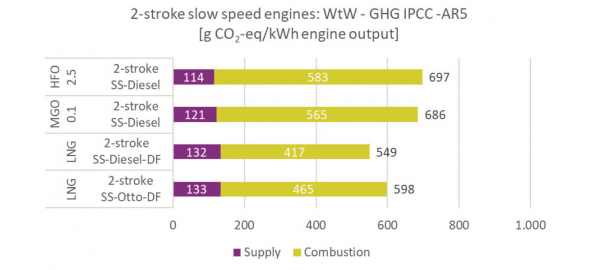

INDEPENDENT STUDY CONFIRMS LNG REDUCES SHIPPING GHG EMISSIONS BY UP TO 23%

13th April 2021

Peer-reviewed well-to-wake study updates definitive figures for GHG emissions from LNG as a marine fuel

The fundamental binary decarbonisation choice facing owners

2nd February 2021

In 2021 Outlook for LNG, “A View from the Bridge” Peter Keller, our chairman outlines the fundamental binary choice facing newbuilds in 2021, as decarbonisation forces a choice between using LNG now, or retrofitting later.

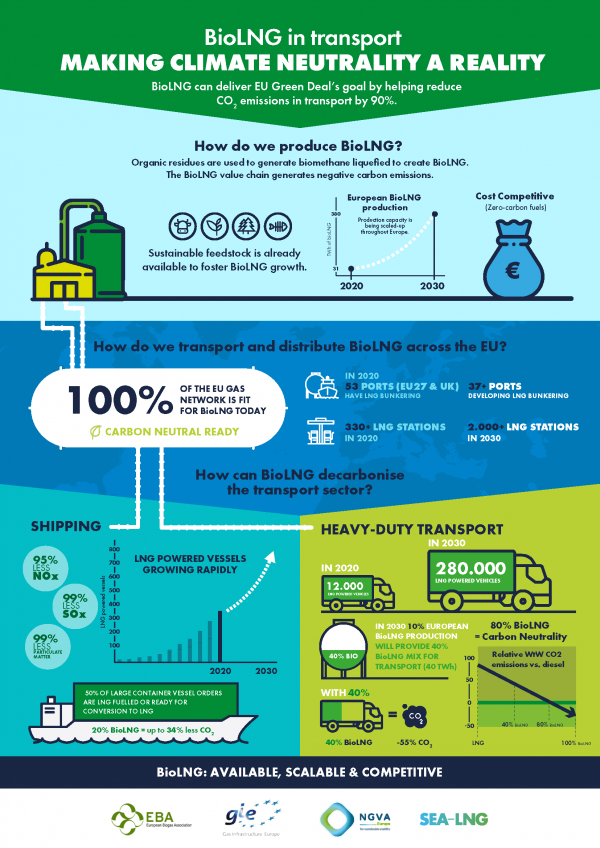

New joint paper: ‘BioLNG makes carbon neutrality a reality for EU transport’

23rd November 2020

Brussels, 23 November 2020 - today, the European Biogas Association (EBA), Gas Infrastructure Europe (GIE), the Natural & bio Gas Vehicle Association (NGVA Europe) and SEA-LNG published a joint paper, which demonstrates the concrete benefits of using BioLNG to decarbonise hard to abate transport sectors through the provision of the latest facts and figures.

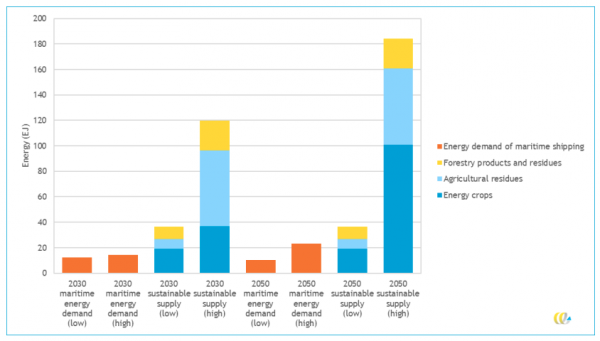

Availability and costs of liquefied bio- and synthetic methane – the maritime shipping perspective

26th March 2020

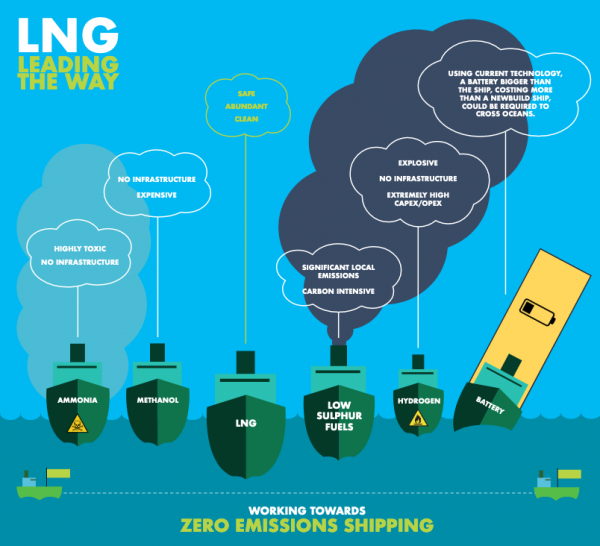

The shipping industry faces unprecedented challenges if it is to meet the IMO’s decarbonisation targets.

LNG as a marine fuel – the Capesize Ore Carrier investment opportunity

27th February 2020

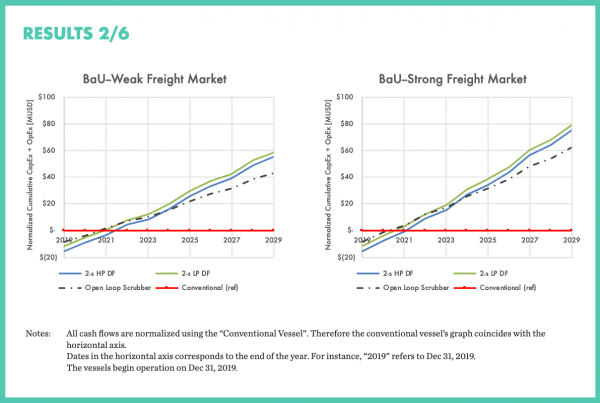

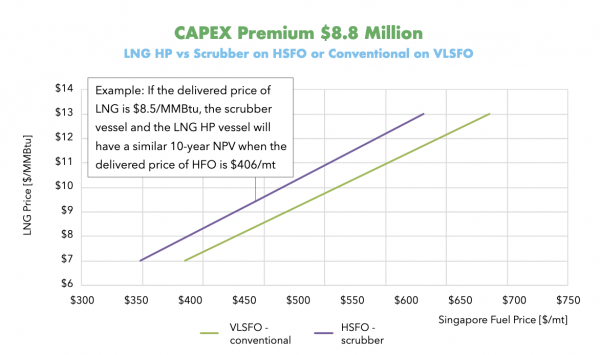

SEA-LNG has commissioned the fourth in its series of independent studies by simulation and analytics experts Opsiana

LNG as a marine fuel – Our zero emissions future starts now

13th February 2020

SEA-LNG's 'View from the Bridge' 2019-2020. Now that we have passed 1st January 2020, the much anticipated global sulphur cap is finally a reality. The importance of this clean air initiative for global health is widely agreed and should not be under emphasised.

LNG as a marine fuel – the VLCC investment opportunity

11th December 2019

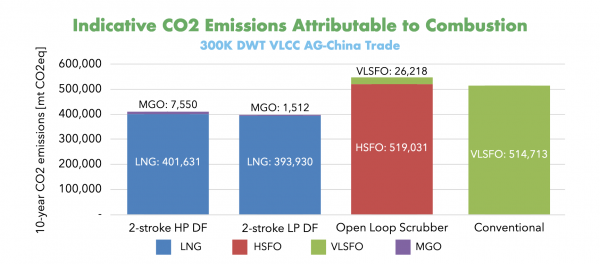

The VLCC investment case study explores the relative investment performance of LNG as a marine fuel for a newbuild 300K DWT VLCC on the Arabian Gulf to China trade route, in comparison with other alternatives currently available and scalable to the shipping industry across three fuel pricing scenarios.

Comparison of Alternative Marine Fuels

17th September 2019

Environmental regulations controlling emissions of SOx, NOx and Greenhouse Gases (GHG) are transforming the global shipping industry. Carbon-intensive, polluting heavy fuel oil (HFO) can no longer remain the default option for ocean voyages.

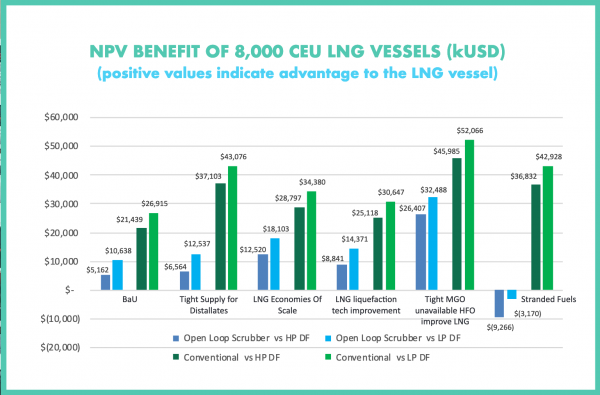

LNG as marine fuel – the PCTC Investment opportunity

11th July 2019

Liquefied Natural Gas (LNG) is a safe, mature, commercially viable marine fuel offering superior local emissions performance, significant Greenhouse Gas (GHG) reduction benefits and a potential pathway to a zero-emissions shipping industry.

Life Cycle GHG Emissions Study on the Use of LNG as Marine Fuel

11th April 2019

This report is the definitive study into GHG emissions from current marine engines

LNG as a marine fuel – the Containership Vessel investment opportunity

23rd January 2019

The study is based on a newbuild 14,000 TEU container vessel plying its trade on an Asia-US West Coast (USWC) liner routing.